Analysts study the income statement for insights into a company’s historic growth and profitability. The balance sheet provides relevant information about a company’s liquidity and financial strength. The goal for management is to ensure costs increase proportionately to revenues. With this information, management can look further into which costs are causing this relationship and implement effective cost cutting procedures. Management typically performs this analysis on each account to track the company’s financial progress year over year.

What is your current financial priority?

Next, Barbara needs to calculate her estimated sales for the upcoming year. Arm your business with the tools you need to boost your income with our interactive profit margin calculator and guide. Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos. 11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements.

Less Accurate for Fast-Growing Businesses

Say for example that Jim believes he can increase company revenue (sales) to $400,000 next year. Because the percentage-of-sales method uses common financial ratios and percentages, it’s a good tool for quickly comparing how a company is doing compared to its competitors or the wider market. Following a few simple steps, you can forecast future revenues and expenses to ensure your business stays on track. Divide your line item amounts by the total sales revenue amount to get your percentage. Another key advantage of the percentage of sales method is that it helps develop high-quality estimates for items closely correlated with sales. Learn how to use the sales revenue formula so you can gauge your company’s continued viability and forecast more accurately.

- The meaning and purpose of the percentage of sales method and aging of accounts receivable can be confusing for individuals new to the finance world.

- The percentage of sales method predicts future finances based on current revenue.

- It looks at the financial statements to find the expenses and assets that can predict future financial performance, relying on accurate historical data to make the future forecasted sales work.

- Next, Barbara needs to calculate her estimated sales for the upcoming year.

- This takes the credit sales method a step further by calculating roughly how much a company can expect not to be paid back from customers if they haven’t paid their credit sales after 90 days.

Easy to compare across businesses

For the sake of example, let’s imagine a hypothetical businessperson, Barbara Bunsen. She operates a specialty cake, army bed, cinnamon roll shop called “Bunsen’s Bundt, Bunk Bed, Bun Bunker” or “B6” for short. We’ll use her business as a reference point for applying the percent of sales method. Retained earnings represent the amount of earnings that have been retained in the business since the company started operating. For example, if the CGS ratio increased to 65 percent next year, management would have to examine why their production costs are increasing relative to sales. This could happen because of a number of supply issues or environmental changes.

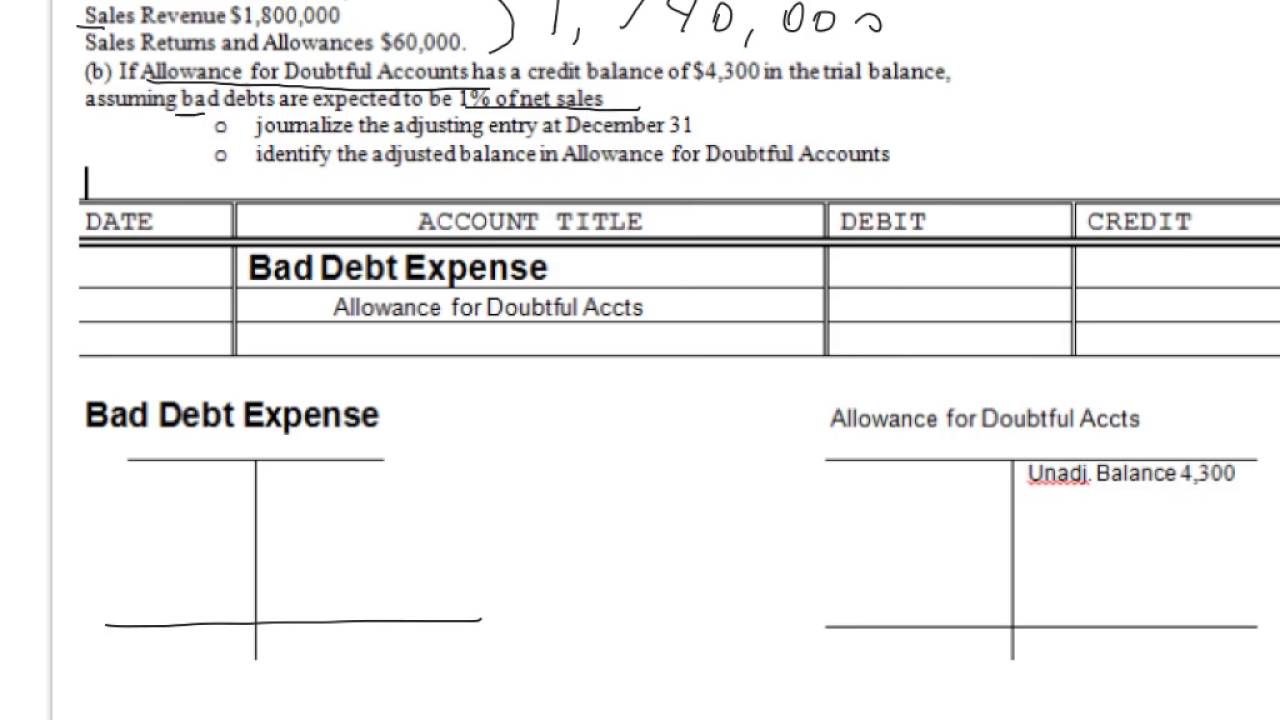

The balance in this account will always be a function of a predetermined percentage of credit sales when the net-sales method is used. As we will see later the balance in the Allowance for Uncollectible Accounts is simply a result of the entry to record the estimated uncollectible accounts expense for the period. Checking up to see how the actual figure is progressing against the predicted one helps to manage accounts receivable accordingly and tighten collection processes for businesses. This takes the credit sales method a step further by calculating roughly how much a company can expect not to be paid back from customers if they haven’t paid their credit sales after 90 days. That also makes it handy for working out in the forecasted financial statements what’s performing well and what isn’t, and by extension setting financial goals for the company.

Customers

Before making predictions regarding financial health, businesses must accumulate data concerning their expenses and sales. Organizing the data before calculating can improve the process’s efficiency and accuracy. To calculate your potential bad debts expense (BDE), simply multiply your total credit sales by the percentage you anticipate losing. Best practices when using the Percentage of Net Sales Method include regularly monitoring sales figures and inventory levels to ensure accurate reporting and compliance with tax regulations. It is also important to establish controls and procedures to prevent the manipulation of sales figures. Additionally, it is recommended that companies periodically review their inventory costing methods to ensure that the Percentage of Net Sales Method continues to be the most appropriate for their needs.

Reviewing historical data of uncollectible accounts and the industry benchmark for bad debt expenses can work out the percentage needed for the forecast. A business would need to forecast the accounts receivable or credit sales using the available historical data. Understanding how quickly customers pay back credit sales over different periods, such as 30, 60, and 90 days, also helps.

With changing budgets and different needs every month, it’s important to know where your money is going and how it affects future earnings. Frank had a holiday hit selling disco ball planters online and he wants to know what his expenses and assets will look like if sales keep going up. If this percentage were 20% the previous year, Panther Tees’s management team would like to know why procuring the t-shirts costs more. After identifying the cause of the increase in procurement cost, the organization must take the necessary measures to increase its margins. Let us look at his review of the independence and effectiveness of the operations evaluation department calculation example to understand the concept better. The method also doesn’t account for step costing — when the cost of a product changes after a customer buys a quantity of that product over a discrete volume point.