This means that the figures for cash inflows and outflows, and therefore the accounting rate of return, are inaccurate. The accounting rate of return, or ARR, is another method of investment appraisal. The accounting rate of return measures the profit generated compared to the initial investment. The accounting rate of return (ARR) is a formula that shows the percentage rate of return that is expected on an asset or investment. This is when it is compared to the initial average capital cost of the investment. The rate of return (ROR) is a simple to calculate metric that shows the net gain or loss of an investment or project over a set period of time.

Internal Rate of Return (IRR) and Discounted Cash Flow (DCF)

Each of these approaches has distinct advantages and disadvantages, but they are all used to determine the property’s fair market value. The decision rule argues that a firm should choose the project with the highest accounting rate of return when given a choice between several projects to invest in. ARR takes into account any potential yearly costs for the project, including depreciation. Depreciation is a practical accounting practice that allows the cost of a fixed asset to be dispersed or expensed. This enables the business to make money off the asset right away, even in the asset’s first year of operation. They are now looking for new investments in some new techniques to replace its current malfunctioning one.

- Since the AAR figure is not comparable to a market return, we are unable to distinguish between profitable and unprofitable investments.

- The Accounting Rate of Return (ARR) Calculator uses several accounting formulas to provide visability of how each financial figure is calculated.

- 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links.

- Here we are not given annual revenue directly either directly yearly expenses and hence we shall calculate them per the below table.

Narrow scope of analysis

(1) Find the Average Net Income in the ARR formula by averaging all the figures on row 22, which arrives at $12.1m. Note that we divide by 2 because we are looking for the average of opening balance of assets’ book value and ending balance of assets’ book value. Read on as we take a look at the formula, what it is useful for, and give you an example of an ARR calculation in action.

What is Accounting Rate of Return (ARR): Formula and Examples

An accelerated depreciation method, for instance, would have a totally different impact on the net income figures. Very often, ARR is preferred because of its ease of computation and straightforward interpretation, making it a very useful tool for business owners, key stakeholders, finance teams and investors. While it can be used to swiftly determine an investment’s profitability, ARR has certain limitations. Accounting Rate of Return formula is used in capital budgeting projects and can be used to filter out when there are multiple projects, and only one or a few can be selected.

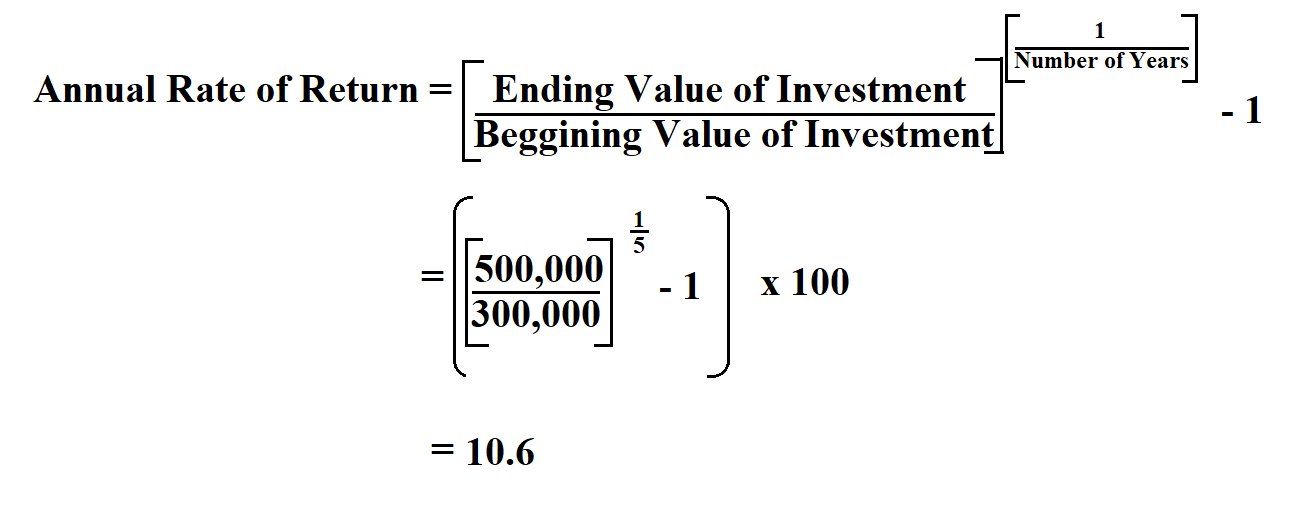

ARR does not include the present value of future cash flows generated by a project. In this regard, ARR does not include the time value of money, where the value of a dollar is worth more today than tomorrow. A rate of return (RoR) is the net gain or loss of an investment over a specified time period, expressed as a percentage of the investment’s initial cost. When calculating the rate of return, you are determining the percentage change from the beginning of the period until the end. ARR for projections will give you an idea of how well your project has done or is going to do.

Accounting Rate of Return helps companies see how well a project is going in terms of profitability while taking into account returns on investments over a certain period. The Accounting Rate of Return is the overall return on investment for an asset over a certain time period. It offers a solid way of measuring financial performance for different projects and investments.

Get granular visibility into your accounting process to take full control all the way from transaction recording to financial reporting. AMC Company has been known for its well-known reputation of earning higher profits, but due to the recent recession, it has been hit, and the gains have started declining. For example, you invest 1,000 dollars for a big company and 20 days later you get 300 dollars as revenue. If so, it would be great if you could leave a rating below, it helps us to identify which tools and guides need additional support and/or resource, thank you.

Assume, for example, a company is considering the purchase of a new piece of equipment for $10,000, and the firm uses a discount rate of 5%. After a $10,000 cash outflow, the equipment is used in the operations of the business and increases cash inflows by $2,000 a year for five years. The business applies present value table factors to the $10,000 outflow and to the $2,000 inflow each year for what is the turbotax audit defense phone number five years. Once the effect of inflation is taken into account, we call that the real rate of return (or the inflation-adjusted rate of return). The simple rate of return is considered a nominal rate of return since it does not account for the effect of inflation over time. Inflation reduces the purchasing power of money, and so $335,000 six years from now is not the same as $335,000 today.

Say that you buy a house for $250,000 (for simplicity let’s assume you pay 100% cash). The average annual rate of return for the total stock market between 2013 and 2023, as measured by the growth of the S&P 500 index. Note that actual returns vary widely from year to year, and from stock to stock. So, the project returns an average of 4% from the initial investment in net profit.